Fah Mai Holdings Group is a leading bulk spirit trader, producer, and global distributor, with expertise in the fields of portfolio management and investment strategies. Our extensive network and market knowledge allow us to source and supply premium spirits globally.

At Fah Mai Holdings, our story started with a passion for fine whisky and a vision to make it accessible to all. Over the years, we have evolved into a trusted partner for businesses and individuals alike, seeking to navigate the whisky market. Our rich heritage is built on years of experience and a commitment to excellence. We identify and present unique opportunities, ensuring customers can make informed decisions.

At FMH we partner with some of the best in the business. Get to know our partner brands below

Diageo is a British multinational company specialising in the production and distribution of premium alcoholic beverages globally.

Whyte & Mackay is a Scottish company renowned for producing and distributing alcoholic beverages, with an emphasis on Scotch whisky.

Pernod Ricard is a French multinational corporation specialising in the production and distribution of wines and spirits around the world.

Speyside Cooperage specialises in the craft of making and repairing oak casks, which are essential for ageing Scotch whisky

Aceo Ltd is a UK company in the whisky and spirits industry, offering a range of services including cask sales, storage, bottling and labelling.

Young Spirits is a bottling and labelling company based in Edinburgh, Scotland, specialising in small-batch spirits, including whisky, gin, and vodka.

Holyrood Distillery, established in 2019, is Edinburgh’s first operational single malt whisky distillery in a century. Located near Holyrood Park.

Kentucky Artisan Distillery located in Crestwood, Kentucky, is a craft distillery known for bourbon production and being the home of Jefferson’s Bourbon.

8 Doors Distillery is a relatively new Scotch whisky distillery based in John O’Groats, in the far northeast of Scotland, it is the most northerly in the UK

Cask World is an investment company that offers individuals and institutions the opportunity to purchase and trade whole casks of world whisky.

At Fah Mai Holdings, we have achieved numerous milestones that reflect our passion and dedication. Each step has been informed by years of expertise and solidified our place in the industry. Let us guide you through our key achievements, showcasing how we blend tradition with modern strategies over time.

Inception

Fah Mai Holdings was founded in 2017 by Louis Haseman, driven by a deep-rooted passion for whisky and a vision to bring rare and valuable spirits into the hands of discerning collectors and investors. What began as a personal journey of collecting and curating some of the world’s most sought-after bottles evolved into a company with a clear mission: to make whisky investment more accessible, transparent, and rewarding.

Louis’s journey into the world of whisky was anything but accidental. With years of hands-on experience sourcing and acquiring rare bottles, he developed not only a refined palate but also a sharp eye for value and authenticity. His fascination with the craftsmanship, history, and culture behind each bottle laid the foundation for Fah Mai Holdings’ unique approach—combining traditional appreciation with modern investment sensibilities.

The story begins with a boy, born in the Philippines and adopted at birth, who was raised and educated in the UK. His journey into whisky started with drinking and appreciation then moved into collection and trading. 12 years later, Fah Mai Holdings was born, and we began working with our customers and suppliers.

Our story includes many milestones: our first IPO, pioneering fractionalised whisky casks, launching our independent bottling brand, surviving COVID, breaking a Guinness World Record, starting import and distribution, acquiring the Whisky Live franchise for Thailand, finding our distillery plots, and planning our NASDAQ IPO.

From its inception, the company has grown with a focus on integrity, education, and community. Louis wanted to create more than just a portfolio of prized bottles; he envisioned a platform where people from all walks of life could explore the world of whisky collecting, whether as a passion, a financial opportunity, or both. Fah Mai Holdings continues to reflect this ethos—bridging the gap between collectors and investors, and between the love of whisky and the future of alternative asset investing.

We still have an unfinished story to tell. Let us share our experiences, milestones, achievements, and journey so far.

Formation

After a quick visit to New York and a walk down Wall Street to embody where we would one day end up being traded, Fah Mai Holdings Ltd UK, Fah Mai Holdings Inc. USA, and Fah Mai Holdings CO., LTD. Thailand was formed. Our first year was about structuring the correct platform to complete an IPO and raising enough capital to start building our portfolio. Our founder injected his personal capital and brought in the initial 24 investors which gave us ample startup funding.

At this point in time whisky had shown that it could, over time give above and beyond an average of 20% value appreciation in a year. So we planned on spending 80% of our capital on assets and 20% on operations. At the above rates, logically by the end of the first 12 months the assets would have appreciated to the point where they would have returned the capital expense of operations to zero.

We designed the branding, formalised the concept of the business and drew up all of our contracts, terms of business, created the first brochures and built the website and opened our first office in Bangkok, Thailand.

We started with graphic design and marketing content to promote our new concept on social media which at the time was a lot newer and easier to navigate. Our audience was 95% male aged 35+ at this time, and so a clever marketing campaign was created for our female customers to strategically diversify our target audience.

We then reached out to long-term business partner Mr. Daniel Monk and offered him a partnership and presidency to assist with the fundraising and growth of the business. Towards the middle of the year, Daniel joined, and FHM was off.

The initial strategy was to raise capital, allocate funds to appreciating assets, and pursue a public listing once sufficient value had been realised. Following consultation with our advisors, it was recommended that we also establish recurring revenue streams to support liquidity and trading interest post-IPO. In response, we developed a plan to launch a proprietary bottling brand. However, given the time required for whisky maturation, we implemented an innovative solution to unlock early value from our maturing cask inventory—this led to the creation of Platinum Cask.

We commenced IPO preparations with KCCW and Now CFO as our US GAAP accounting partners. Concurrently, our legal advisors initiated the drafting of our registration statement, placing us on the path toward listing.

Platinum Cask was conceived as a member-only platform, designed to provide access to the capital growth potential of whisky cask ownership without requiring individuals to purchase entire casks. This concept—referred to as “cask fractions”—allowed fractional ownership of individual casks. In parallel, the brand served as our registered bottling label, releasing curated single cask expressions.

The cask fractions model was analogous to fractional real estate investment. Each cask was partially divested by offering 49% ownership at its original acquisition cost. Over time, as the cask matured and appreciated, the retained equity generated a return for the company, similar to traditional asset-based investment strategies.

To formalise operations, we established Platinum Cask Ltd within our corporate structure, assigning it responsibility for bottling, brand management, and holding of cask and bottle assets.

By the end of 2017, Fah Mai Holdings had begun building its portfolio, acquiring initial casks and bottles, completing its first bottling run, and launching Platinum Cask. Early marketing efforts were deployed, and supplier relationships were further cultivated with a long-term objective of securing direct procurement from leading industry producers such as Diageo, Beam Suntory, Pernod Ricard, and Whyte & Mackay.

Expansion

In early 2018, we travelled to Scotland in pursuit of acquiring what was, at the time, the world’s largest privately held collection of whisky casks. Our offer was initially accepted; however, a subsequent higher bid from another party superseded ours. That transaction ultimately did not complete, and by then, we had already shifted focus to other opportunities. During our visit, we toured Macallan, Broxburn, Glenfarclas, and Tormore, as well as the renowned Dowans House. The journey, not without its challenges, included several snowstorms that temporarily disrupted our travel.

Planning also began for Platinum Cask’s first bottling series—The Olympians—featuring twelve single cask expressions, each themed after a figure from Greek mythology. The inaugural releases were to be Artemis and Poseidon, with label illustrations commissioned from Mrs. Susan Haseman, the founder’s mother and a lifelong watercolour artist.

To support our public listing objectives, we expanded our sales and marketing team at our Thailand office. This expansion was instrumental in onboarding the minimum number of selling shareholders required for OTC listing eligibility. The IPO auditing process proved extensive and time-consuming. During this period, we transitioned from KCCW to Pinnacle Consulting, who would continue as our auditor for the subsequent three years. By year-end, we submitted our first registration statement to the U.S. Securities and Exchange Commission for review.

Our first high-profile cask sale was a 2009 Dalmore, which achieved a return of 200%, selling for triple its original acquisition cost.

In the first half of 2018, we invested over £400,000 in our bottled whisky portfolio and secured ownership of 40 additional casks. High buyer premiums across existing online auctions prompted us to consider launching our own platform—both as a cost-effective acquisition tool and as a future exit strategy for our portfolio. To this end, we registered Rare Whisky Auctioneers Ltd and secured licensed premises via one of our shareholders.

Shortly thereafter, we received a legal challenge from Whisky Auctioneer regarding the similarity of our trading name. While evaluating alternatives, we reflected on the strong growth of the whisky collecting and investment market and the opportunity to innovate within the auction space. Our aim was to create the lowest-cost global auction platform, distinguished by a unique offering: paying commission to sellers. This led to the conception of Whisky Bull, a name inspired by the founder’s tenacity and a childhood moniker. His mother, once again contributing creatively, was asked to paint a Highland bull to serve as the brand’s emblem.

A specialist developer was contracted to build the auction platform. Despite significant investment and extensive planning, the platform failed to function reliably; timekeeping was inconsistent across browsers and geographic regions, and the bidding mechanism was unreliable—ultimately rendering the site unusable.

That same year, we attended our first Whisky Live event in Manila. The scale of public engagement—over 3,000 attendees—highlighted the strong and growing demand for whisky in Southeast Asia. The event established new regional relationships and reinforced our view that Thailand represented a promising market for whisky culture.

We also completed our first Macallan cask sale through the Platinum Cask platform—a 1990 hogshead that sold out within days. The cask was resold three months later, delivering a 45% return to its fractional owners.

Notably, it was during this period that we first met our current Chief Technology Officer, whose contribution has since been instrumental in delivering our newly launched digital infrastructure.

Maturation

In 2019, our President and CEO of the company relocated to the United Kingdom to establish a new Platinum Cask office. This facility would serve as the hub for our expanding bottled whisky collection and act as the base from which to launch our next-generation online auction platform. We engaged MTC Media to develop Whisky Bull Auctions Version 2, and transferred our licensing to new premises at 4 Davis Way, Fareham. Additionally, we commenced our application for WOWGR licensing—at the time, a regulatory requirement for storing spirits in bonded warehouses without the need for a duty representative.

At this stage of our IPO journey, we received 21 formal questions from the U.S. Securities and Exchange Commission regarding our registration statement. One significant concern related to the sale of cask fractions to U.S.-based investors. In response, we were required to rescind all such transactions, repurchase the associated whisky, and remove any U.S.-domiciled individuals from the platform. This process was complex and led to several months of delay in the SEC review.

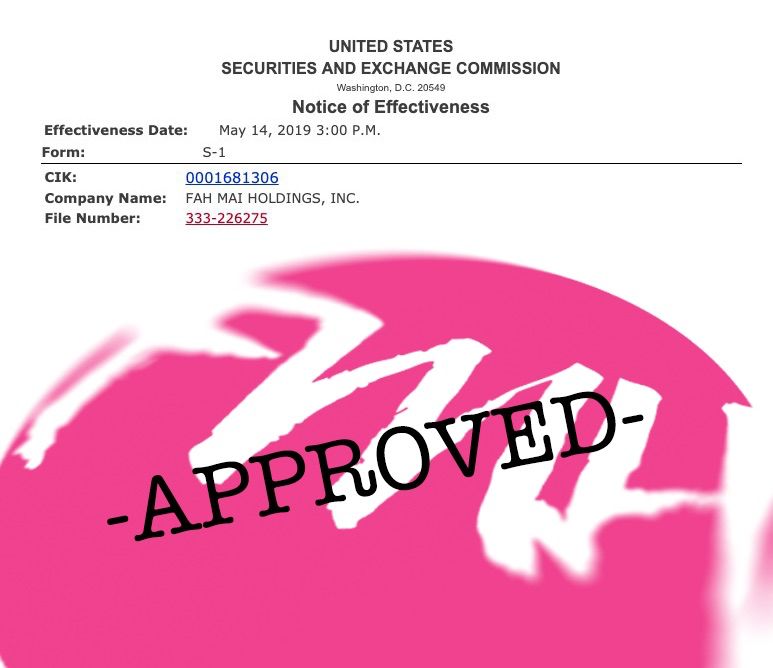

Nevertheless, on 14 May 2019, our application for OTC listing was approved, marking the successful completion of our first IPO registration. The final step to becoming a publicly traded company was the submission of the 15C211 application to secure a trading ticker—a milestone that was now within reach.

In parallel, we toured the United Kingdom to meet our new shareholders and members and undertook site visits to all bonded warehouses holding our casks for physical verification. We also met with landowners to evaluate potential sites for constructing our warehouse—an opportunity that, in hindsight, would have been strategically beneficial. Our team collected the bottled portfolio from LCB for relocation to the new UK office, and visited Scotland’s most utilised cooperage to observe the cask-making and refurbishment processes first-hand.

During a visit to Glen Grant, we acquired one of their oldest and most exclusive expressions as a gift for our largest investor.

We also initiated our first bulk spirit trading agreement with Bladnoch Distillery.

Later that year, our story was featured in The Independent under the headline “Taking Whisky into Another Dimension.” Around this time, we began exploring the acquisition of whisky from non-Scottish distilleries—an approach that was relatively uncommon within the industry. This initiative was led by our President, who founded Rosewin Holdings to distinguish the world whisky division from the Scotch-focused operations of Platinum Cask.

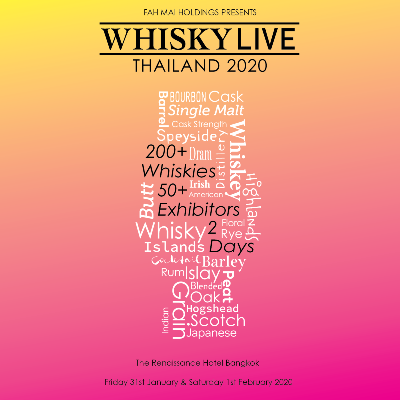

We acquired the franchise rights to Whisky Live for Thailand and began preparations for the country’s first-ever hosting of the event. Given Thailand’s strict regulations prohibiting alcohol advertising, promotion, or online sales, this represented a rare opportunity to activate brand engagement and educate consumers about the cultural and investment value of whisky. It was also the first time our CEO experimented with online video advertising—an endeavour he soon discovered was not to his preference.

The development timeline for the auction site extended significantly beyond initial expectations. During this delay, two new competitors entered the market, placing us at a relative disadvantage by the time we launched.

The year concluded with a visit to Paris, where we met with La Maison du Whisky to inquire about acquiring any remaining stock of Karuizawa casks. Unfortunately, no inventory was made available for sale.

Recognition

In early 2020, preparations were underway for the debut of Whisky Live Thailand. The event brought together 40 exhibitors representing over 100 distinguished brands, including Macallan, Balvenie, Glenfiddich, Glenfarclas, and Amrut. Despite limitations on alcohol promotion within Thailand, our local team executed the event with professionalism and precision. While attendance was modest, the event achieved its core objective of elevating whisky’s visibility in a highly regulated market.

One of the key outcomes from the event was the signing of a three-year import and distribution agreement with Amrut, India’s leading single malt whisky. At the time, Amrut was not widely available within its domestic market, making international travel retail the logical entry point. Over the following three years, we worked to establish and promote the brand, ultimately launching it through a dedicated spin-off event under the Whisky Live umbrella. This marked our first foray into import and distribution, offering valuable operational experience and insight.

Following the event, our team travelled to Florida and New York to visit a range of unconventional and boutique distilleries, including Burlock and Barrel, Trainwreck, Fishhawk, and Van Brunt Distillery in Brooklyn. Van Brunt stood out not only for its location in the heart of New York City, but also for the vision and innovation of its founder, Mr. Daric Schlesselman.

During this U.S. trip, we also crossed paths with Todd Weisel, founder of Baxus, and reconnected with our associate Danny Saltman, co-owner of Dalkeith Brokerage. Exploring the contrasts and commonalities between U.S. and Scottish whisky production was revealing—highlighted by moments as unusual as recreational shooting behind a warehouse at one facility.

Meetings were also held with our legal and auditing teams to review the status of our 15C211 ticker application, which remained under process at that time.

Afterward, the President and CEO took a short sabbatical to complete a trek to Everest Base Camp, accompanied by friends Nathaniel and Gregg, and eight-year-old Amelia Monk. Ever mindful of opportunity, they brought with them 14 bottles from our imported whisky portfolio to create engaging content at base camp. However, as the trip concluded, the COVID-19 pandemic escalated globally, and border restrictions forced a return to the United Kingdom rather than to Thailand.

With the onset of the global lockdown, operations were scaled back and restructured for online engagement. It was during this period that the concept of The Intrepid was born—an ambitious attempt to set a Guinness World Record by producing the largest bottle of whisky ever made. Initially conceived as a cost-effective marketing campaign, the project evolved under the leadership of our President into a high-profile collaboration involving globally recognised explorers, and a tribute to the late Captain Stanley Monk, an adventurer who inspired the project’s name and spirit.

Two 1989 Macallan hogsheads were secured for the bottling, and a custom 300-litre glass vessel—manufactured in Eastern Europe—was delivered to our warehouse. Robotic laser measurements ensured precision in surpassing the previous record of 228 litres set in 2012 by Famous Grouse.

The search for leading explorers to endorse The Intrepid led to an unorthodox encounter with Sir Ranulph Fiennes. After identifying his likely location, our President approached his residence and was, by sheer luck, granted an audience. Sir Ranulph remarked that he was rarely at that property and had been due to depart that day—a fortuitous meeting that set the stage for broader collaboration. Ultimately, eleven distinguished explorers joined the project:

Sir Ranulph Fiennes

Sir Robin Knox-Johnston

Dr. Geoff Wilson

Karen Darke MBE

Olly Hicks

Sarah Outen MBE

Dwayne Fields FRGS

Levison Wood FRGS

Felicity Aston MBE

Jamie Ramsay

Will Copestake

Each participant brought a unique story and legacy of exploration, from polar expeditions and ocean crossings to mountaineering, marathon running, and scientific achievement. These individuals collectively represented the values of resilience, curiosity, and endurance that defined the project.

Despite substantial progress, the unveiling of The Intrepid was postponed due to the global pandemic. Compounding this, further complications arose with our public company. The SEC identified two legacy shareholders—both of whom were involved in selling the original shell—as associated with unrelated enforcement actions. Their continued involvement posed the risk of designating our application as linked to “bad actors,” which would have permanently impaired the listing and implicated the founder. One shareholder agreed to relinquish their position; the other proved unreachable, requiring us to pursue alternative avenues.

By August 2020, The Intrepid had been completed. The 50-kilogram bottle, encased and transported with military-grade protection, was successfully filled and validated for volume using laser instrumentation.

Later that year, Whisky Bull Auctions finally launched. After overcoming extensive development delays, we hosted our first auction with 160 curated bottles—a modest but meaningful milestone in the brand’s evolution.

Meanwhile, our membership base continued to expand, and in October, we released Poseidon, the second expression in the Olympian Series: a 25-year-old Jura single malt bottled under the Platinum Cask label.

In December 2020, we held the second Whisky Live Thailand event, this time in Pattaya, focused on introducing Amrut to the Thai market. Unfortunately, logistical disruptions caused by COVID-19 delayed the arrival of our initial shipment, limiting sales on the day. Nevertheless, the event served to increase brand visibility and awareness within a challenging regulatory environment.

Diversification

2021 marked a year of both significant milestones and profound challenges for Fah Mai Holdings.

We began the year on a somber note with the loss of two valued team members: Chief Operating Officer Paul Lambrick and General Manager Ornprapa Blore. Their contributions to the business were instrumental in shaping our early operations, and their absence was deeply felt across the organisation.

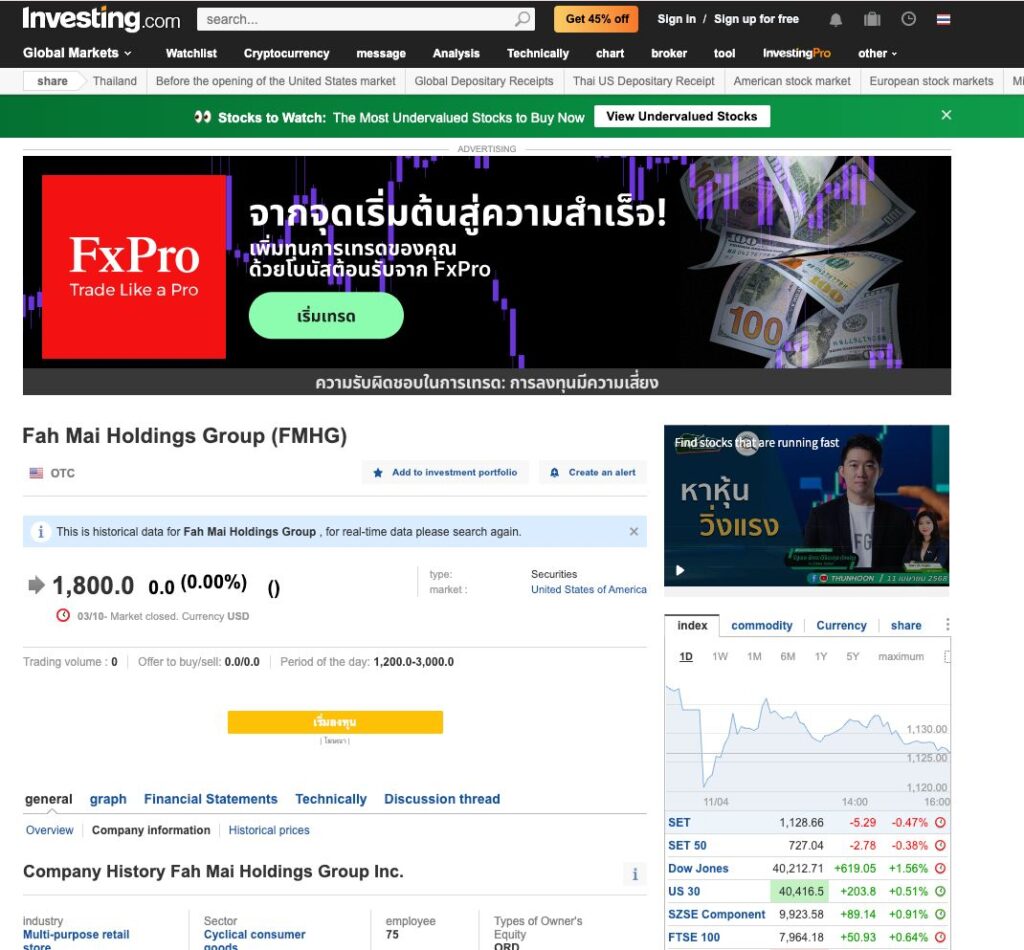

Despite this, the company achieved one of its most important corporate milestones. After ongoing complications with the original ticker application process—caused by legacy shareholder issues—we successfully acquired a trading OTC shell. Through a reverse merger, we transferred all compliant entities and assets into the new structure, excluding any parties associated with previous regulatory concerns. The company was renamed Fah Mai Holdings Group Inc., and began trading under the ticker symbol FMHG at an initial price of USD 1.10 per share. This marked a major step forward in our long-standing IPO strategy. Early trading momentum was positive, with shares reaching USD 3.00 at their peak. However, as with all complex developments, further challenges would soon emerge.

The continued effects of the COVID-19 pandemic had broad implications across the industry. One of the most impactful was Diageo’s suspension of bulk spirit sales to third parties, citing both surging global demand and logistical disruptions within their production network. This forced us to adapt our procurement strategy.

In response, we expanded our import operations. Building on the momentum of our Amrut distribution agreement, we also began importing Bladnoch, marking our second brand in the portfolio.

The pandemic also led to the indefinite postponement of Whisky Live events, which had become a vital part of our brand-building and community engagement efforts in Southeast Asia. In lieu of in-person events, we refocused our efforts on product development and internal growth.

One of the key highlights of the year was the continuation of the Olympian Series under the Platinum Cask label. Four new expressions were released:

HADES – 28-Year-Old Teaspooned Balvenie

126 bottles – 52.9% ABV – £285

HERA – 12-Year-Old Speyside Single Malt

250 bottles – 57.6% ABV – £75

VULCAN – 12-Year-Old Islay Single Malt (Unnamed Caol Ila)

333 bottles – 56.6% ABV – £67

DEMETER – 18-Year-Old Linkwood

250 bottles – 51.8% ABV – £125

These were added to the previously released POSEIDON (180 bottles, £180) and ARTEMIS (310 bottles, £50), completing the first half of the twelve-part series. Custom-designed wooden display cases were also introduced for collectors of the full set.

To streamline our financial operations and reduce audit complexity, we consolidated the company structure by winding down Platinum Cask Ltd and Whisky Bull Auctions Ltd, transferring both brands under Fah Mai Holdings Ltd. This strategic consolidation enhanced operational efficiency and unified all UK-based value into a single audited entity.

Meanwhile, Whisky Bull Auctions completed its sixth live auction in April—executed without issue—and now boasts over 1,200 registered members. Our bottles continue to perform strongly, often fetching prices that rival or surpass those of more established platforms. We are currently preparing to integrate a U.S.-based distribution and collection office, and await final website updates to reflect this international expansion. The U.S. office will operate as a direct extension of Whisky Bull Auctions, not as a separate entity.

On the record-breaking front, The Intrepid project reached its final stages. The two Macallan casks arrived at the bottling facility, underwent re-gauging, and were nearing their 32-year maturity mark. On 9 September 2021, after navigating pandemic-related delays, we officially broke the Guinness World Record for the largest bottle of whisky—a landmark achievement reflecting the perseverance and commitment of the team, particularly under the guidance of Daniel Monk.

We also partnered with Andrew Stotz and his team to implement a cloud-based accounting system, simplifying audit preparation and financial transparency across the group.

Our business lines expanded further:

Cigars were introduced under the Platinum Cask brand.

We completed our first wholesale cask sales through the fractional ownership platform—building on the precedent set by our inaugural Dalmore cask sale.

The company surpassed 1,000 casks in its total portfolio, a notable benchmark of scale and maturity.

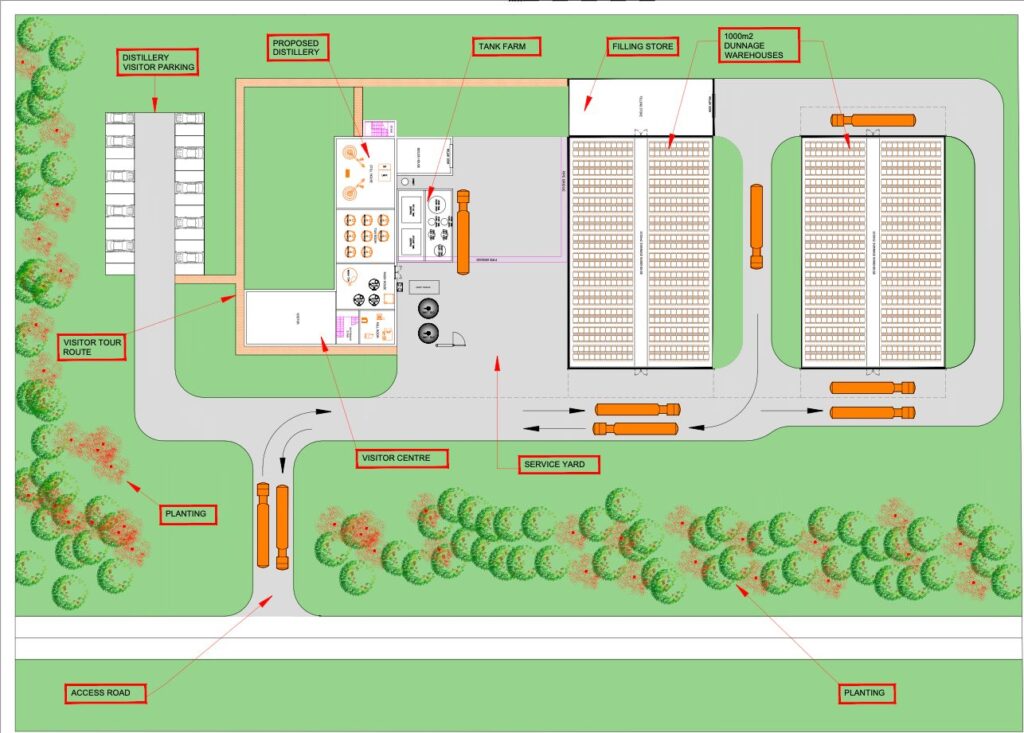

In parallel, we began scoping the development of our own whisky distillery, potentially located at the Dell Estate. By year-end, Heads of Terms were signed, and branding, planning, and web infrastructure were underway.

Following the approval of our WOWGR licence, we completed our first bulk spirit acquisition from Diageo, enabling us to expand our role in the bulk trade segment.

Our sourcing efforts continued with a visit to John o’ Groats, resulting in an agreement with 8 Doors Distillery to secure spirit allocations once their production commenced. Simultaneously, we began acquiring bulk Bourbon from Kentucky Artisan Distillery and James Bay Distillery in the United States—diversifying our supply network and strengthening our global cask offering.

Innovation

The year 2022 proved to be one of contrasting outcomes—marked by continued commercial growth and strategic progress, but not without its share of setbacks.

On a positive trajectory, the company maintained its record of consecutive year-on-year revenue growth since inception. Operational momentum was strong, and by mid-year, we were on course to deliver one of our most commercially successful periods to date.

Our bulk spirit trading division continued to perform exceptionally well, generating consistent monthly revenue and cementing long-term relationships with several leading suppliers. Among these, we secured a forward contract with Ardgowan Distillery for the annual purchase of 250,000 litres of new-make spirit (NMS), to commence upon the start of their production. This agreement further strengthened our upstream supply capabilities and expanded our strategic partnerships in the sector.

Earlier in the year, significant progress had been made toward establishing our own distillery. The Dell Estate project had reached the planning stage, with all branding, architectural design, and technical submissions prepared. Unfortunately, unforeseen developments at the estate prevented the project from progressing. While the sunk cost was considerable, the vision remained intact. Later in the year, an alternative opportunity emerged at the Sutherland Estate, within the grounds of Dunrobin Castle—a historically rich site with significant potential as a new home for the distillery project.

A major internal change occurred mid-year, as the longstanding partnership between Daniel Monk and Louis Haseman came to a close. Daniel stepped away from his operational role to pursue a lifelong ambition of sailing around the world. While his contributions to the company’s foundation and development were substantial, the business required full-time leadership moving forward. Louis assumed sole leadership and continued to guide the company into its next phase.

An unexpected and disruptive development followed shortly after: our audit partner, Pinnacle, declared bankruptcy. Unbeknownst to us, the firm had been suffering from the prolonged financial and operational impacts of the COVID-19 pandemic. This unfortunate event meant our audit could not be completed in time, leading to a missed financial reporting deadline and a temporary trading status downgrade. This setback required an immediate reassessment of our compliance protocols and audit partner selection process.

In contrast, Whisky Bull Auctions experienced a year of strong performance and accelerated growth. Auction volume more than doubled, consistently exceeding 1,000 lots per auction by year-end. This growth reflected both increased member engagement and the growing reputation of the platform within the collector and investor community.

A major highlight of the year was the sale of The Intrepid—our record-breaking 311-litre bottle of 32-year-old Macallan. Listed at Lyon & Turnbull, the auction concluded with a sale price of £1.1 million, placing the bottle among the most valuable single whisky items ever sold and delivering both revenue and global media exposure for the brand.

We also explored diversification through a potential partnership with Seadrift Distillery, a producer of non-alcoholic spirits. Our aim was to import and distribute their products within Thailand. However, the high cost of regulatory compliance—including FDA and customs clearance hurdles, combined with pricing challenges and the complexity of establishing a new drinks category—ultimately led us to halt the initiative. The decision was made to remain focused on our core business in alcoholic spirits, where we hold substantial competitive advantage and infrastructure.

In terms of innovation, we collaborated with Coinbag to introduce cryptocurrency wallet services for clients and implemented a crypto-based payment solution—broadening our accessibility to a wider investor base and aligning with emerging payment trends.

Brand development also received renewed focus. With the expertise of a former Diageo brand consultant, we conducted a complete rebrand across all business units. A unified brand book was released, establishing a consistent colour palette and visual identity across the group to enhance brand cohesion and public perception.

Strategically, we expanded our global reach by establishing a physical presence in New York, designed to support Whisky Bull Auction’s North American operations. Simultaneously, we entered into a partnership with Liquid Gold Auctions in Singapore—making us the only whisky auction platform capable of receiving and distributing consignments across three distinct regions: Europe, North America, and Asia.

Accelaration

2023 marked a period of rapid expansion, structural transformation, and strategic repositioning across multiple facets of the business.

A renewed focus was placed on the import and distribution division, particularly targeting entry into modern trade channels across Thailand. Initial efforts were directed through CPF, encompassing major retailers such as Tesco Lotus, Makro, and 7-Eleven. By year-end, Glenlee Blended Whisky had successfully entered Tesco Lotus stores. In addition, a custom-designed bottle was developed to launch a brandy product specifically tailored for the modern trade segment, demonstrating adaptability in packaging and market positioning.

International exposure was further enhanced through participation in Whisky Lux in Tokyo, which also marked the inception of new wealth management partnerships with institutions based in Japan—an initiative aligned with the company’s long-term investor engagement strategy.

A major milestone occurred in April, during meetings with a Singapore-based investment bank, which recognised the company’s growth trajectory and the regulatory challenges encountered during the initial OTC listing. As a result, the bank agreed to act as underwriter for a prospective listing on a major U.S. exchange (NASDAQ or NYSE). This marked a significant strategic shift, as the original pathway had assumed a phased approach to up-listing. With the support of the underwriter, preparations commenced for a direct listing, including the engagement of a new auditor and the initiation of a fresh US GAAP audit cycle.

Further meetings were held in Singapore before the bank conducted on-site due diligence at the company’s Thailand offices. Advisory services commenced shortly thereafter, with a view to ensuring full regulatory and governance readiness. As part of this transition, independent candidates were interviewed for key board-level positions across audit, compensation, and governance committees, in compliance with listing requirements.

During this period, the business became one of only four entities authorised to bulk import spirit into Thailand from the United Kingdom, further solidifying its position as a leading regional importer.

The sharp increase in trade volume prompted an organisational expansion. Staff numbers grew from 12 to nearly 40, with strategic hires including a Chief Financial Officer (CFO), Chief Technology Officer (CTO), in-house legal counsel, a compliance team, and additional personnel in sales and marketing. A new Chief Operating Officer (COO) was appointed through internal promotion, and a dedicated marketing office was established in the Philippines. Simultaneously, a specialised B2B sales unit was created to serve wholesale and institutional accounts more effectively.

However, the rapid scale-up exposed several operational inefficiencies. The accelerated onboarding of new staff, combined with limited training infrastructure, led to reduced performance in certain business areas entering 2024. The high cost of expansion, without a proportional uplift in productivity, placed strain on several departments and temporarily impacted overall profitability.

Despite these challenges, portfolio diversification continued. The company added new brands to its import roster, notably AD Rattray whiskies and Filibuster Bourbon, expanding both product range and market appeal.

Revenue and asset accumulation reached record levels. This performance was largely underpinned by the ongoing success of Platinum Cask, which benefitted significantly from the appointment of Barry Johnston as CTO. Under his leadership, the long-anticipated cask fraction trading platform was completed, enabling an entirely new channel for customer acquisition and asset realisation.

Conversely, the collectible bottle market experienced a decline, largely attributed to broader macroeconomic pressures and rising living costs across key consumer markets. This downturn negatively affected Whisky Bull Auctions, with bottle valuations decreasing and trading volume contracting. Nevertheless, the company’s bulk spirit trading operations remained robust, continuing to deliver stable revenue and reinforcing the importance of maintaining diversified revenue streams within the business.

Consolidation

2024 was a year defined by resilience, strategic diversification, and the continued evolution of Fah Mai Holdings across multiple verticals.

The year began with the audit process in its final stages, and all preparations were in place to file the company’s updated registration statement. As part of a broader initiative to ensure long-term compliance and institutional-grade reporting, the company proactively began vetting top-tier global audit firms. Discussions commenced with leading names such as PwC, EY, KPMG, Grant Thornton, and Fruci Associates, reflecting the company’s ambition to align with partners capable of supporting its listing on a major U.S. exchange. This step was viewed as a strategic upgrade that would strengthen governance, reporting infrastructure, and long-term investor confidence.

The company also expanded its physical footprint and development capabilities. A key acquisition was made in Thailand with the purchase of land designated for future distillery construction. This site will serve as a strategic regional base, complementing the brand’s global operations. Concurrently, the team identified Cape Wrath as a promising location for a new Scottish distillery. Full planning approval was secured, with proposals to deliver the project in two phases: initial build and subsequent production. Designs for both facilities were completed, and groundwork commenced to bring both ventures to life.

In addition to infrastructure expansion, the company enhanced its brand-building activities. The inaugural issues of Platinum World—a curated publication dedicated to whisky and luxury lifestyle—were released, positioning the brand as a thought leader within the premium spirits and collectibles market. The publication attracted engagement from connoisseurs and collectors across global markets, adding further prestige to the Platinum Cask ecosystem.

Operational refinement was also a priority during the year. As part of an optimisation strategy, the organisational structure was reviewed to align resources with core business objectives and ensure sustained profitability. This reorganisation ensured that the company remained agile and efficient as it prepared for its next growth phase.

Import activities expanded significantly, with the addition of new brands across whisky, rum, and tequila categories. These acquisitions reflected the company’s strategic shift towards becoming a diversified spirits distributor. Planning also began for Whisky Live Thailand 2024, which would serve as the launch platform for these new brands, combining exposure with direct consumer engagement.

Product innovation continued with the development of a custom miniature bottle, designed to mirror the signature seven-sided Glenlee bottle. This limited-edition item included a bespoke presentation box, adding to the brand’s growing portfolio of collector-grade packaging and luxury presentation formats.

A key highlight of the year was the successful hosting of Whisky Live Thailand 2024 in mid-November. The event featured over 40 exhibitors and more than 150 premium brands, drawing a highly engaged audience of whisky enthusiasts and trade professionals. The production quality, venue execution, and community reception were widely praised, reinforcing the company’s capability to deliver world-class events that align with its premium market positioning.

While the company strategically reallocated resources to deliver the event, the internal teams displayed remarkable dedication and adaptability. The combined efforts of the operational, marketing, and event teams not only elevated the company’s profile in Southeast Asia but also laid the groundwork for future brand activations.

As 2024 drew to a close, both distillery projects were nearing execution, and two leading audit firms—PwC and Fruci Associates—were in final consideration for engagement. Simultaneously, Fah Mai Holdings was formally recognised as suitable for fund management designation, opening the door to future partnerships with institutional investors.

Despite a year of major internal initiatives and external activity, the company closed 2024 well-positioned for a renewed phase of accelerated growth, underpinned by world-class partners, infrastructure readiness, and a diversified brand and asset portfolio.

Legacy

The company remains well-positioned for continued growth, supported by significant progress across financial, operational, and strategic domains. This multidimensional development reflects a deliberate and disciplined approach to long-term value creation.

The establishment of dedicated investment funds in Dubai and Thailand strengthens the company’s capital structure and provides a robust platform for expansion into key global markets. These structures are designed to attract institutional capital, support asset growth, and enhance international investor engagement. Concurrently, the appointment of a new audit partner reinforces the company’s commitment to transparency, regulatory compliance, and best-in-class governance. Ongoing collaboration with experienced underwriters further signals strong confidence in the company’s growth trajectory and facilitates efficient access to capital markets in pursuit of its public listing objectives.

Within the Platinum Cask division, several milestones have been achieved. The completion of the Olympian Series bottlings marks a significant phase in product development, combining collector appeal with brand heritage. The launch of both fractional and whole cask trading platforms has introduced an accessible, data-driven channel for whisky investment, while the release of curated tasting packs enhances client engagement and experiential marketing.

Digital infrastructure continues to advance, with the launch of three new websites that optimise user experience, strengthen brand visibility, and support strategic marketing initiatives across multiple customer segments. These platforms are designed to underpin future growth in cask trading, auctions, and investor relations.

Further demonstrating its operational ambitions, the company has finalised plans for a new corporate office and completed architectural and logistical planning for its first distillery facility in Scotland. With the building warrant process underway, the development signals the company’s transition toward integrated production capabilities and a broader value chain presence.

Strategic expansion of the distribution and supply network remains central to the company’s commercial model. Enhanced import partnerships and regional logistics frameworks have improved access to key markets, strengthening the company’s competitive position across both retail and B2B channels. Two potential acquisitions are currently under consideration, each offering the potential to accelerate brand portfolio growth, unlock new revenue streams, and deepen market penetration.

Together, these initiatives reflect a comprehensive and forward-looking strategy, laying a solid foundation for sustainable performance and long-term success within the global premium spirits industry.

Our services include alcohol distribution, portfolio management, cask sales, and market insights, all designed to empower you. Whether you’re a seasoned whisky expert or new to whisky, we create tailored strategies to help you achieve your goals. Join us as we blend tradition with expertise, guiding you towards lucrative outcomes.

Fah Mai holdings is currently building the first of multiple distilleries. Our initial projects are currently underway in Scotland and Thailand, and our initial releases will mark our pioneering spirit and entry into the world of production, forging FMH position in all aspects of Whisly production, all the way to distribution. We also operate Platinum Cask, our exclusive boutique bottling brand, releasing single cask editions of curated whisky expressions, and tastefully curated casks aged our way.

At Fah Mai Holdings, we are ready to help you uncover exciting opportunities. Whether you are a business looking to explore opportunities, a spirits brand looking to expand global distribution, or you’re looking to diversify your portfolio and learn more about the market, our team is here to provide the insights and support you need.

Browse and download our

brochures and exclusive offers to learn more about

Fah Mai Holdings.