We offer specialised advice, guidance and management services for those looking to start or expand a portfolio of casks. We will craft a portfolio specifically tailored to meet your goals. The concept of cask ownership is simple “buy a cask, own it, sell it”, but there are considerations to take into account.

Cask investment, specifically, is predicated on the ownership of casks with the speculative expectation of value appreciation. Based on the historical value growth within the industry over the past two decades and the disparity between production costs and retail pricing of bottled products, a substantial value differential exists that may be exploited for financial gain. But it requires time.

In Layman’s terms, you invest your money in a whisky cask or casks and hope that when you sell it, you make more than it cost to buy it.

do not believe everything you read or hear online about whisky casks. The returns are not as some would make out over short periods of time. To really see a highly competitive return on your capital you need to be ready to invest in whisky for 5-10 years as a minimum. There was a time between 2020-2023 when the broker market for casks was in its infancy and the alternative asset class that whisky has become was being formed where not many had access and there was a high demand for new owners in the market.

During this period due to the volumes required by new companies being setup to broker casks and manage private portfolios, there was a window of opportunity to process trades at a high volume with greater returns than had previously been seen. In 2025 the market has established itself and is not going anywhere but so have the number of companies in the trade.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Click Below To Learn More

A deficit of time constitutes a significant risk. It is recommended to allocate a minimum of three to five years for whisky maturation to observe value appreciation and to further mitigate price fluctuations resulting from supply and demand variations, a period of five to ten years is advised. Future events are inherently unpredictable. Throughout the years, instances have arisen wherein individuals have sought to divest casks shortly after acquisition for various reasons stemming from unforeseen circumstances. In such cases, it is recommended to postpone investment activities until a prudent cash reserve is established to address such contingencies, thus allowing the casks to reach the maturation dates provided by our advisors.

Investing capital that one cannot afford to maintain throughout the maturation period presents a notable risk. Should one allocate funds necessary to address potential unforeseen circumstances, liquidating the cask in a timely manner to meet these exigencies may prove unfeasible. We advise our clientele against committing funds to cask investments if they lack prudent cash reserves.

Discussions regarding pricing are warranted. You need to buy the cask at the best possible price to enhance the returns. Typically, proximity to the original producer of a commodity in a business context correlates with lower product costs. Thus, acquiring a cask directly from a distillery would theoretically yield the most advantageous price point. However, this principle is not invariably applicable to whisky. AS the cost of production varies depending on the size of the distillery. As is characteristic of supply chains, the producer’s expenditure is minimal, wholesalers incur the next lowest, followed by progressively increasing prices implemented by distributors, brokers, and bottlers.

Price variations within the supply chain are observed across distinct tiers. These tiers, arranged from lowest to highest pricing, are typically categorized as follows: Producer (distillery), Bulk Spirit trader or wholesaler, Broker tier 1 (a broker acquiring from a wholesaler or producer), and Broker tier 2 (a broker acquiring from another broker). It should be noted that this structure is not universally consistent. Certain brokers possess direct access to producers, while others do not. Moreover, disparities in financial resources enable some brokers to secure lower prices through economies of scale.

Fraudulent activity and misleading practices pose significant risks in contemporary investment and purchasing markets. The proliferation of online transactions has unfortunately facilitated the operation of scammers and unscrupulous entities, which may offer nonexistent or misrepresented goods. In the context of whisky acquisition, such scams and the mis-selling of products represent the primary threats to consumers. This was not historically the prevailing circumstance. Therefore, it is imperative to conduct thorough due diligence regarding prospective vendors. Verification of registration and a trading history exceeding three years, indicating establishment, is advisable. While recognising the emergence of new market entrants, scrutiny of the individuals comprising such entities is warranted. An assessment of their tenure within the industry and the experience qualifying them to provide reliable guidance should be undertaken.

Verification of the product’s existence, location, and specifications, including bulk volume, ABV, and cask types, is recommended during due diligence. For aged and higher-value casks, obtaining the latest regauge figures will ensure accurate purchase data.

While obtaining a cask is relatively straightforward due to numerous brokers and distilleries selling directly, the true challenge lies in selling it. This requires a network of bottlers or secondary market traders. While this shouldn’t be difficult with a well-matured cask, individual sellers are advised to seek guidance from an experienced team that can manage purchases and establish an exit strategy beforehand. Those dreaming of having their cask bottled and sold for the same prices the original brands are selling their bottles for need to consider the value of the brands themselves, along with the increased cost of bottling and the challenges associated with selling bottles.

Whisky has consistently appreciated in value over the years, making it a compelling addition to an investment portfolio. As demand for fine spirits continues to grow, so does the potential return on your investment.

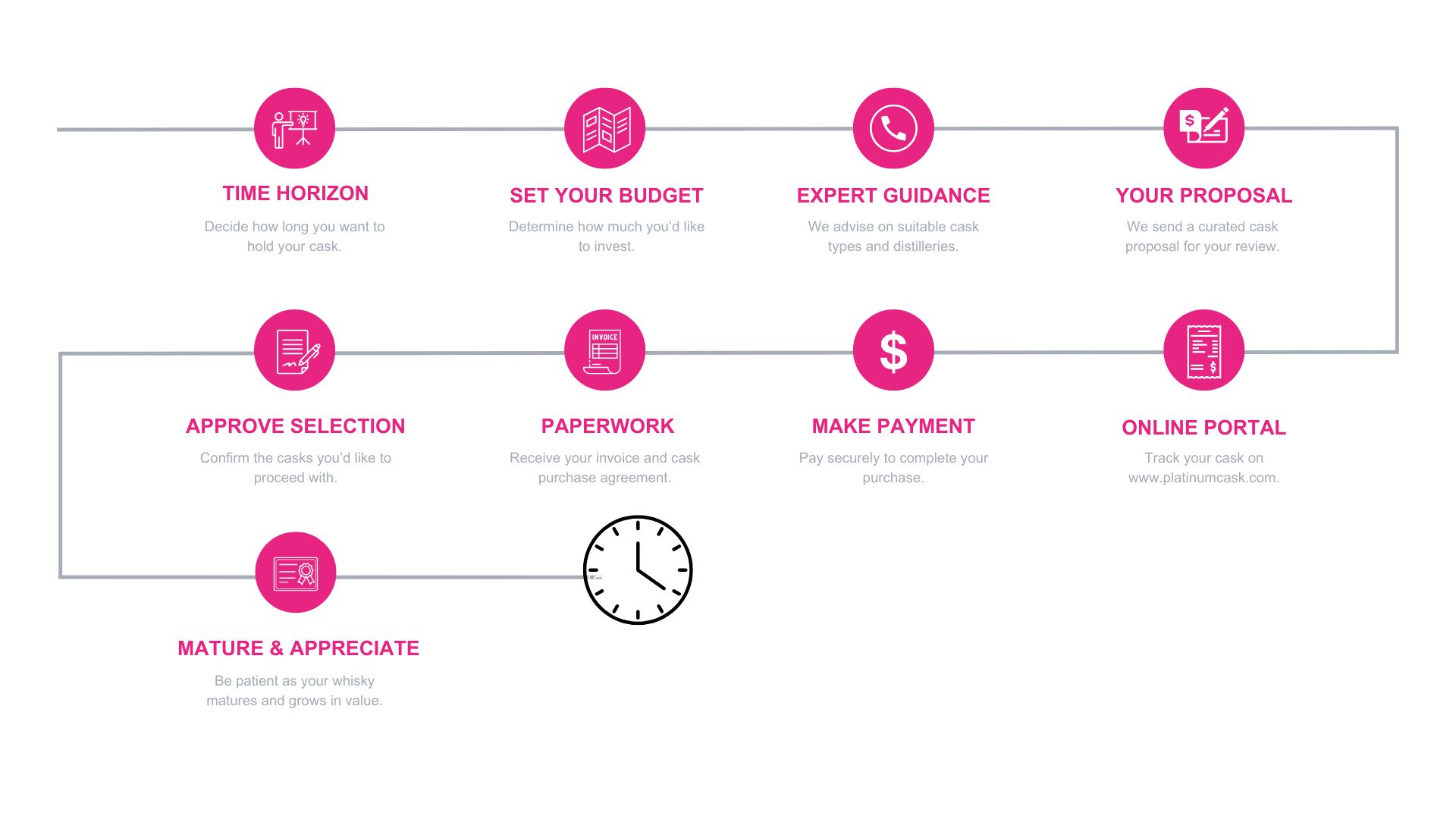

Getting started is easy. Contact us for a personalized consultation where we’ll assess your investment goals and guide you through the process of acquiring whisky casks tailored to your needs.

Like any investment, whisky does carry some risks, including fluctuations in market demand. However, our expert team is here to help you navigate these challenges and secure your investments.

Yes, whisky casks can be sold, and our team can assist you in finding the best market options when you’re ready to liquidate your investment. Due to the unpredictable nature of buyer acquisition, this process may not be executed instantaneously. Therefore, it is imperative to allocate a sufficient timeframe for divestment before necessitating the capital for subsequent utilisation.

We provide regular market evaluations and reports based on the secondary market prices and trade volumes. We use this data to keep you informed about the value of your cask and its performance. You will be given an annual or biannual valuation report.

Browse and download our

brochures and exclusive offers to learn more about

Fah Mai Holdings.